Parler

Parler Gab

Gab

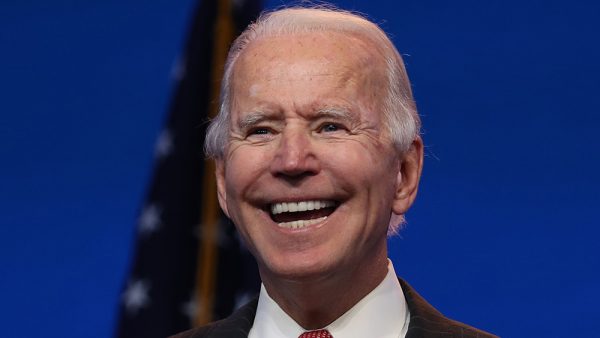

Biden projects led to record high in fuel costs

Biden's Build Back Better led to a record high in fuel costs and it's an educated guess that raising interest rates will devastate the entire world. A strategic risk consultant and lecturer, Engdahl, a graduate of Princeton University, noted that the Fed has used "core inflation" to get rid of politically damaging consumer inflation monthly data that showed increasing oil and grain prices. Core inflation means consumer price rises minus energy and food. Disgraced President Richard Nixon used the term in 1975 to fake the data. "Core inflation is a scam because American consumers had to pay far more for gasoline and bread. Very few real people can live without energy or food," stressed Engdahl. Presently, the U.S. Consumer Price Index does not include the cost of buying and financing houses, and also property taxes or home maintenance and improvement which have been soaring. The Fed should issue a statement admitting that inflation is more alarming than they thought. This situation requires aggressive rate hikes to "squeeze inflation out of the system." Aided by near-zero Fed rates and $120 billion of monthly purchases by the Fed of bonds, Wall Street with stocks at historic highs could start a panic exit from stocks to get out. This, of course, will trigger panic selling and a snowballing market collapse, which will make the real estate and stock collapse of Evergrande small time. Engdahl noted that the Federal Reserve and major banks like ECB in the EU and the Bank of Japan gave zero interest rates and "quantitative easing" purchases of bonds to bail out the major financial institutions and Wall Street and EU banks in utter disregard of the health of the real economy. The largest bailout in the history of brain-dead banks and financial funds resulted in the artificial inflation of the greatest speculative bubble in stocks in history. As s savvy businessman, Donald Trump knew that the new record rises in the S&P 500 stocks as proof of the booming economy, was a lie because of the Fed zero interest rate policy.American economy sinking

With massive labor shortages, lockdowns and supply chain problems coming from China, the U.S. economy is sinking and Biden’s phony "infrastructure" bill will do little to rebuild the vital economic infrastructure of highways, rains, water treatment plants and electric grids. The Fed is preparing for the stock crash in 2022 which it will use to usher in a real Great Depression, It will be worse than what happened in the 1930s because the savings of ordinary Americans will be wiped out. Biden's tax on corporate stock buybacks resulted in S&P 500 companies buying back $742 billion of their own shares. Whether the Fed will reduce its buying of treasury securities as well as home mortgage bonds. The COVID-19 pandemic hysteria led to huge buying and Federal Reserve holdings of securities have more than doubled from $3.8 trillion to $8 trillion at the end of October 2021. The U.S. also manipulated employment data and inflation numbers. This happened during the Vietnam War era under Lyndon Johnson. Presently, private economist John Williams of Shadow Government Statistics, estimated that the actual unemployment rate in the U.S. is over 24.8 percent which is far from the reported 4.2 percent for November. The fragile U.S. and global financial system will collapse if rates will be raised. Citizens might beg for emergency relief in the form of digital money and a Great Reset. The Washington-based Institute of International Finance in September estimated that global debt levels, which include government, household and corporate and bank debt, rose $4.8 trillion to $296 trillion at the end of June, $36 trillion above pre-pandemic levels. Emerging markets such as Turkey, China, India and Pakistan owed a combined $92 trillion. Watch the full video below of "The Great Reset or the Greatest Hold-up?" This video is from The Prisoner on Brighteon.com. Sources include: GlobalResearch.ca TheEpochTimes.com NoTricksZone.com Williamengdahl.comDeborah Birx hid covid info from Trump, altered CDC guidelines without approval

By Ethan Huff // Share

Americans lining up outside food banks as record inflation continues

By Belle Carter // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share