Parler

Parler Gab

Gab

The collapse has only just begun... and China's FAKE economy is in real trouble

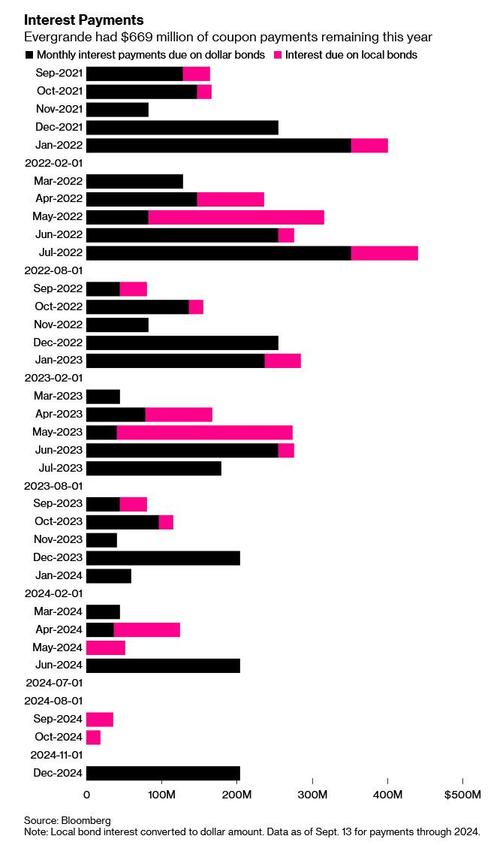

Ponzi schemes collapse when people demand to get paid back for their "investments" but the schemers can't ensnare enough new investors to fund the previous ones who want out. As Bloomberg reports (see chart below), Evergrande owes $669 million in interest debt payments over the next 3 months. According to recent news out of China, it looks like the government there is going to help cover Evergrande's debt payments to local bond holders (i.e. institutions in China) while stiffing foreign bond holders. This is a surefire recipe for causing the financial default to spread internationally: One look at the debt obligations chart above should lead to the instant realization that Evergrande is going to default... and foreign debt holders are going to be left high and dry. Even if the Chinese government covers all the individual local investors and their WMPs (Wealth Management Product investments), it's clear that hundreds of billions of dollars in foreign-held debt is going to be written off at some point (probably soon).

Even worse, Evergrande is just the tip of the iceberg.

"The whole Chinese property market is on stilts," investment expert Jim Chanos told the Financial Times. "...[A]ll the developers look like this. There's lots of Evergrandes out there in China — Evergrande just happens to be one of the biggest."

That means U.S. banks and institutions that invested in Evergrande are going to suffer catastrophic losses. Hence the ripple effect begins, and the non-China investors who had exposure to all this suddenly find themselves unable to make their own debt obligation payments for their own leveraged borrowing.

Why would we not be surprised to discover that banks and institutions around the world borrowed cheap money to invest in Evergrande where they could bank on far higher returns? (Where do you really think all the Fed money printing money goes, anyway? A significant portion is invested by banks in higher interest rate projects around the world, like Evergrande.)

The bottom line result is that Evergrande's collapse will almost certainly set off fiscal contagion. The debt implosion will likely spread, and if regulators aren't able to expertly navigate the magnitude of this collapse, it may turn into an avalanche of failed institutions and banks around the world in 2022.

This won't be instantaneous, of course. Even an avalanche take time to gather speed and momentum. The first big collapse has been ignited and has begun to spread, but much like a tsunami, it travels mostly unseen until it reaches foreign shores, at which time the oceans rise up and dump their catastrophic results in anything that stands in the way.

Today's Situation Update podcast explains more of what's happening with Evergrande and the risk of contagion that may, over time, cause catastrophic losses among global investment institutions and banks:

Brighteon.com/0ad27898-091e-4d04-9db3-b5e9f4ff2471

Brad Harris from Full Spectrum Survival has also offered this warning about what happens next with the Evergrande collapse:

Discover new podcasts and interviews each day at:

https://www.brighteon.com/channels/hrreport

One look at the debt obligations chart above should lead to the instant realization that Evergrande is going to default... and foreign debt holders are going to be left high and dry. Even if the Chinese government covers all the individual local investors and their WMPs (Wealth Management Product investments), it's clear that hundreds of billions of dollars in foreign-held debt is going to be written off at some point (probably soon).

Even worse, Evergrande is just the tip of the iceberg.

"The whole Chinese property market is on stilts," investment expert Jim Chanos told the Financial Times. "...[A]ll the developers look like this. There's lots of Evergrandes out there in China — Evergrande just happens to be one of the biggest."

That means U.S. banks and institutions that invested in Evergrande are going to suffer catastrophic losses. Hence the ripple effect begins, and the non-China investors who had exposure to all this suddenly find themselves unable to make their own debt obligation payments for their own leveraged borrowing.

Why would we not be surprised to discover that banks and institutions around the world borrowed cheap money to invest in Evergrande where they could bank on far higher returns? (Where do you really think all the Fed money printing money goes, anyway? A significant portion is invested by banks in higher interest rate projects around the world, like Evergrande.)

The bottom line result is that Evergrande's collapse will almost certainly set off fiscal contagion. The debt implosion will likely spread, and if regulators aren't able to expertly navigate the magnitude of this collapse, it may turn into an avalanche of failed institutions and banks around the world in 2022.

This won't be instantaneous, of course. Even an avalanche take time to gather speed and momentum. The first big collapse has been ignited and has begun to spread, but much like a tsunami, it travels mostly unseen until it reaches foreign shores, at which time the oceans rise up and dump their catastrophic results in anything that stands in the way.

Today's Situation Update podcast explains more of what's happening with Evergrande and the risk of contagion that may, over time, cause catastrophic losses among global investment institutions and banks:

Brighteon.com/0ad27898-091e-4d04-9db3-b5e9f4ff2471

Brad Harris from Full Spectrum Survival has also offered this warning about what happens next with the Evergrande collapse:

Discover new podcasts and interviews each day at:

https://www.brighteon.com/channels/hrreport

Diminished US refining capacity from facility closures contributing to soaring gas prices

By Belle Carter // Share

Port of Los Angeles director: US supply chain at risk if rail service does not improve

By Mary Villareal // Share

Massive uprising erupts in Panama over inflation and deteriorating economic conditions

By Arsenio Toledo // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share