Parler

Parler Gab

Gab

Affordability challenges impacting demand

Joel Kan, an economist for the MBA, said purchase activity declined for both conventional and government loans as the weakening economic outlook, high inflation and persistent affordability challenges are impacting buyer demand. Buyers are less affected by weekly moves in interest rates, but the broader picture of rising rates has already taken its toll as mortgage rates rose again last week after falling slightly over the past three weeks. (Related: U.S. headed for "unprecedented housing crisis" as mass evictions loom.) The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances of $647,200 or less, increased to 5.82 percent from 5.74 percent, with points increasing to 0.65 from 0.59 for loans with a 20 percent down payment. The rate was 3.11 percent the same week last year. Demand for refinances also fell four percent for the week and was 80 percent lower than the same week last year, with applications now also at a 22-year low. However, the drop in demand from homebuyers caused the refinance share of mortgage activity to increase to 31.4 percent of total applications from 30.8 percent the previous week. Mortgage interest rates have not moved much this week, but that could change soon due to increasing bond market volatility. The Federal Reserve is also expected to hike rates by another 75 basis points next week as other central banks are taking similar actions against inflation. The climb in mortgage rates, coupled with increasing economic uncertainty, has begun to sideline some potential homebuyers amid market slowdown in the United States. Sam Khater, Freddie Mac's chief economist, said consumer concerns about rising rates, inflation and a potential recession are manifesting in a softening demand. "As a result of these factors, we expect house price appreciation to moderate noticeably," he said. Sales were hit particularly hard over the slowdown, with a measure of deals for previously-owned homes dropping to a two-year low in June, according to data from the National Association of Realtors. According to the group, the sales count declined to a seasonally adjusted annualized rate of 5.12 million units last month as sales dropped by 14.2 percent compared to the year before. This is the slowest sales pace for the same month in 2020, when sales dropped very briefly at the beginning of the pandemic. Steep price gains coupled with higher mortgage rates have also created an affordability ceiling, according to George Ratiu, manager of economic research at Realtor.com. "Many Americans are finding they no longer have enough money to purchase a home that meets their needs," he said. Visit MarketCrash.news for more news about the collapsing U.S. housing market. Watch the video below about buyers fleeing the housing market. This video is from the Bull Boom - Bear Bust channel on Brighteon.com.More related stories:

Collapse incoming: Fed to raise interest rates more than the market initially anticipated. Pension funds are buying up entire neighborhoods of single family homes, contributing to America’s housing crisis.Here it comes: All signs point to Housing Bubble 2.0 amid widening price, income gap.

U.S. headed for "unprecedented housing crisis" as mass evictions loom.

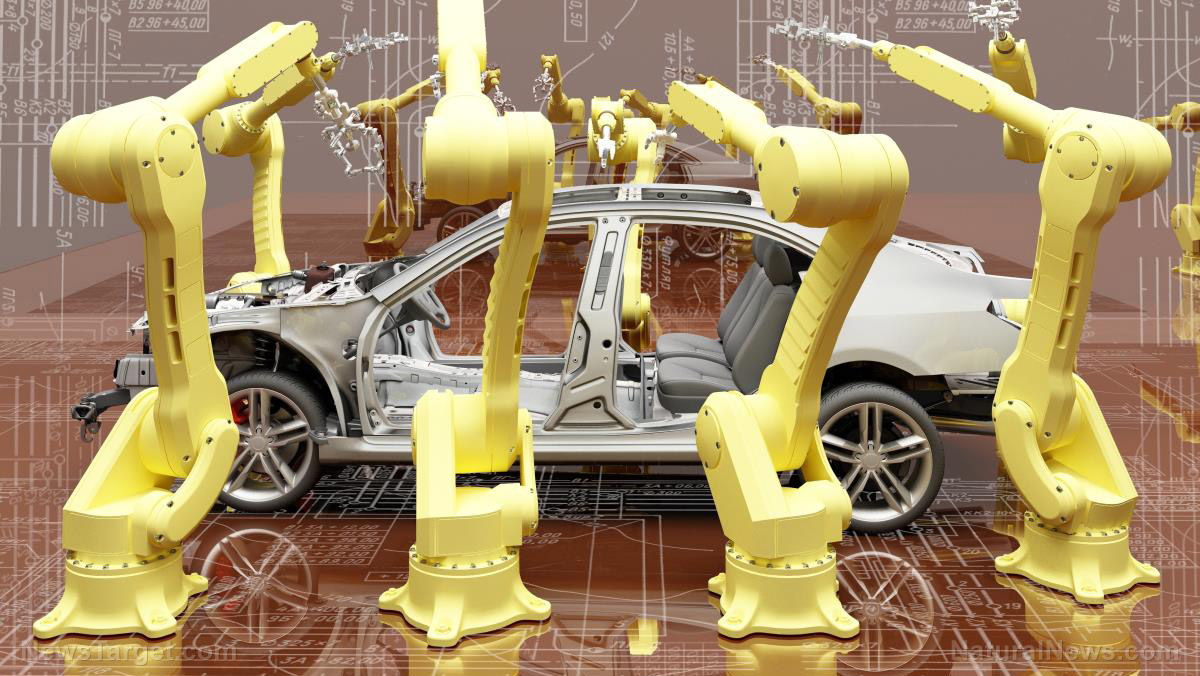

Sources include: CNBC.com 1 CNBC.com 2 Bloomberg.com Brighteon.comNew vehicle retail sales for July expected to DROP by 10.8% year-over-year

By Arsenio Toledo // Share

Coinbase shares down 21% following reports that it is facing SEC probe

By Belle Carter // Share

Protests rock Argentina as socialist government cuts subsidies

By Ramon Tomey // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share