Parler

Parler Gab

Gab

America losing billions of dollars due to decrease in new orders

Last month, the United States made $530.7 billion from new orders for manufactured goods. The 0.4 percent drop might not look like a lot, but keep in mind that the American manufacturing industry accounts for nearly 12 percent of the entire economy. Even a drop of less than half of a percentage means the country is losing out on billions of dollars worth of revenue that could have gone to businesses and their employees. Economists studying the drop in new orders for American-made goods believe that it is caused at least partially by inflation and by businesses still dealing with inventory shortages. This analysis is supported by the Commerce Department's data for unfilled orders. Unfilled orders for December rose by 0.5 percent to reach a whopping $1.27 trillion worth of unfulfilled purchases. Last month, unfilled orders rose by 0.8 percent. This is the eleventh consecutive month that the index for unfilled orders for American-made manufactured goods rose. Adjusted for inflation, inventories in American factories remain well before their pre-pandemic levels. Sales-to-inventory ratios also remain low. The decrease came even though orders for some American-made goods increased in December, such as for machinery, primary metals and fabricated metal products. Any increases were offset by massive decreases in demand for American-made electronic products like computers as well as transportation equipment.American manufacturing will continue suffering if computer chip shortage not addressed

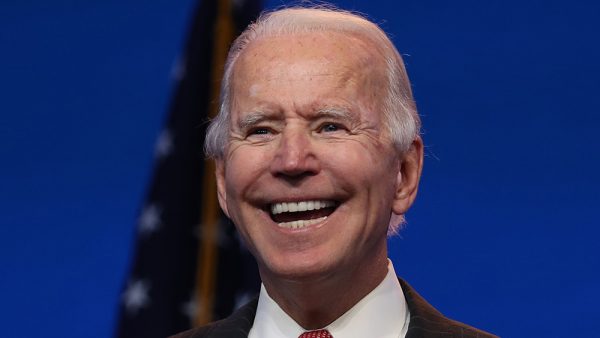

America's supply of semiconductor chips determines the health of many parts of the manufacturing industry, especially for factories that primarily build electronic equipment and other appliances and products that rely on computer chips. In another Commerce Department report, it warned that the U.S. supply of chips has fallen to alarmingly low levels, raising the prospect of dozens, possibly hundreds of factories all over America shutting down. In 2019, right before the Wuhan coronavirus (COVID-19) pandemic, a survey of 150 companies in the U.S. found that they had 40 days supply of semiconductors. Now, these same companies are down to less than five days of inventory. This problem is compounded by the fact that demand for semiconductor chips has grown by 17 percent from 2019. Semiconductor chip shortages have already disrupted many parts of the manufacturing industry, notably the production of automobiles. The slowdown in production has contributed significantly to the over seven percent year-over-year increase in the price of automobiles last month – the largest inflationary period for the industry in four decades. Instead of attempting to resolve this problem on its own, the administration of President Joe Biden has passed this concern on to Congress, citing the need to prioritize stalled legislation that would supposedly solve the crisis by providing $52 billion for domestic semiconductor production. "The semiconductor supply chain remains fragile, and it is essential that Congress pass chips funding as soon as possible," said Commerce Secretary Gina Raimondo in a statement. "With skyrocketing demand and full utilization of existing manufacturing facilities, it's clear the only solution to solve this crisis in the long-term is to rebuild our domestic manufacturing capabilities." Even if Congress passed the bill immediately and provided factories with a $52 billion stimulus for the production of semiconductor chips, it would take years before factories dedicated to producing chips begin production. This begs the question of whether the American economy can wait that long before this crisis is resolved.More related articles:

Inflation is hitting low-income families the hardest, with some now spending 1/3 of their budget on food. Despite wage increases, the average US worker lost money in 2021 due to soaring inflation. Inflation and Biden economic policies forcing more Americans to turn to food banks. Survey finds most global CEOs expect inflation to last through 2023 and beyond. Want to protect your assets against inflation? Consider owning precious metals like gold and silver. Watch this Jan. 24 episode of the "Thrive Time Show" with host Clay Clark as he talks about how the massive inflation caused by Biden's economic policies herald the coming collapse of the American dollar. The "Thrive Time Show" with Clay Clark airs from Monday to Friday at 3:30-4 p.m. on Brighteon.TV. Learn more about the state of the American economy by reading the latest articles at MarketCrash.news. Sources include: Breitbart.com MarketWatch.com Investing.com TeleTrader.com Reuters.com USNews.com Brighteon.comAmericans lining up outside food banks as record inflation continues

By Belle Carter // Share

Diminished US refining capacity from facility closures contributing to soaring gas prices

By Belle Carter // Share

Port of Los Angeles director: US supply chain at risk if rail service does not improve

By Mary Villareal // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share