Parler

Parler Gab

Gab

- The U.S. signed four major trade agreements with Malaysia, Cambodia, Thailand and Vietnam at the ASEAN summit, securing commitments on rare earth minerals and broader economic cooperation to reduce reliance on China.

- With China controlling 80 percent of global rare earth refining and tightening export controls, the U.S. is urgently diversifying supply chains – critical for defense, tech and green energy industries. Malaysia's 16.1 million-ton rare earth deposits and pledge not to ban exports to the U.S. are key wins.

- Vietnam agreed to increase purchases of U.S. goods to narrow its $123 billion trade surplus or face tariffs, while Thailand eliminated nearly $18.8 billion in aircraft and $5.4 billion in energy imports. Malaysia also exempted U.S. aerospace and agricultural products.

- The U.S. and Malaysia will share expertise in refining rare earths, aiming to build independent supply chains outside China's influence. Thailand and Vietnam also aligned with U.S. auto safety standards, benefiting American manufacturers like Ford and GM.

- While the deals weaken China's grip short term, experts warn full decoupling will take years due to China's refining dominance. Beijing is countering with its own partnerships, including a potential Malaysian refinery deal, signaling an ongoing battle for influence in Southeast Asia.

Strategic implications and long-term risks

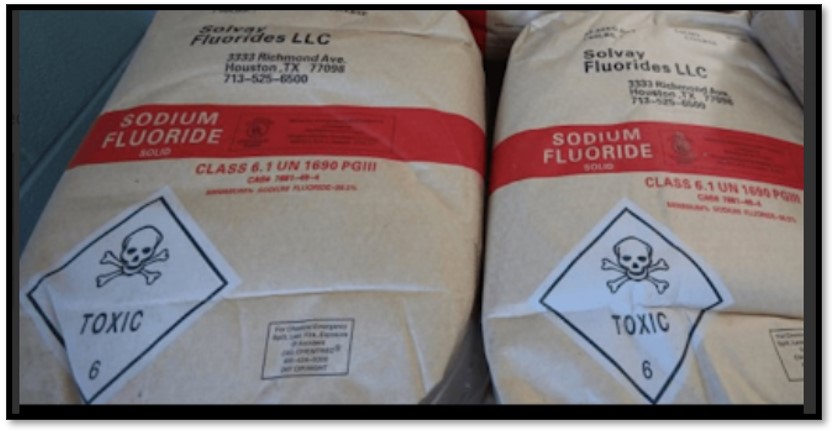

The deals reflect a growing U.S. effort to counterbalance China's economic influence in Southeast Asia – a region increasingly caught between the two superpowers. While the agreements provide short-term relief for manufacturers, experts warn that fully decoupling from China's rare earth supply chain will take years. "The damage has already been incurred," one industry analyst noted, referring to past disruptions caused by China's export controls. Automakers and tech firms are now urgently seeking alternative suppliers in Australia, Canada and Saudi Arabia – but building new refining infrastructure remains a costly and time-consuming challenge. The U.S.-ASEAN agreements mark a significant step in reducing dependence on China, but their long-term success hinges on execution. If Malaysia and other partners can develop competitive rare earth processing capabilities, the deals could weaken Beijing's grip on critical supply chains. However, with China actively negotiating its own rare earth partnerships in the region – including a potential Malaysian refinery backed by a Chinese firm – the geopolitical tug-of-war is far from over. For now, the agreements offer a temporary reprieve for industries reliant on rare earths while signaling Washington's broader strategy: reshaping global trade in favor of U.S. interests, one deal at a time. Watch the video below where Trump declares the U.S. is doing a real job on rare earths with Australia. This video is from the NewsClips channel on Brighteon.com. Sources include: TheEpochTimes.com Reuters.com BrightU.ai Brighteon.comThe fluoride fraud is crumbling: FDA finally confronts decades of poison pills peddled to children

By Lance D Johnson // Share

Trump and Xi Jinping just rescued Europe’s auto industry from collapse

By Lance D Johnson // Share

Sodium nitrite: The toxic preservative hiding in processed meats

By Laura Harris // Share

Treasury Secretary Bessent: China’s rare earth export curbs a “real mistake”

By Ramon Tomey // Share

AI farm robots and food aid stalemate raise concerns over jobs and food security

By Finn Heartley // Share

Governments continue to obscure COVID-19 vaccine data amid rising concerns over excess deaths

By patricklewis // Share

Tech giant Microsoft backs EXTINCTION with its support of carbon capture programs

By ramontomeydw // Share

Germany to resume arms exports to Israel despite repeated ceasefire violations

By isabelle // Share