Parler

Parler Gab

Gab

- Putin orders a long-term strategy for mining and processing rare-earth metals, aiming to capitalize on Russia's reserves (estimated between 3.8M–28.5M tons) and reduce reliance on China, which dominates global production.

- The U.S. and China's trade tensions have intensified competition for critical minerals, with Russia positioning itself as a potential alternative supplier while deepening ties with China and North Korea via infrastructure projects.

- Washington seeks to break China's rare-earth monopoly, with Trump pursuing deals in Ukraine and engaging in talks with Russia – despite strained relations – to secure supply chains vital for tech and military applications.

- Rare-earth metals (17 key elements) are essential for advanced tech, EVs and defense systems. Nations lacking domestic or diversified sources risk supply disruptions and geopolitical coercion by adversaries like China.

- The race for mineral dominance could reshape alliances, trade flows and military balances, with Russia's December roadmap determining whether it becomes a reliable supplier or a disruptor in this high-stakes resource war.

Rare-earths and the future of global power

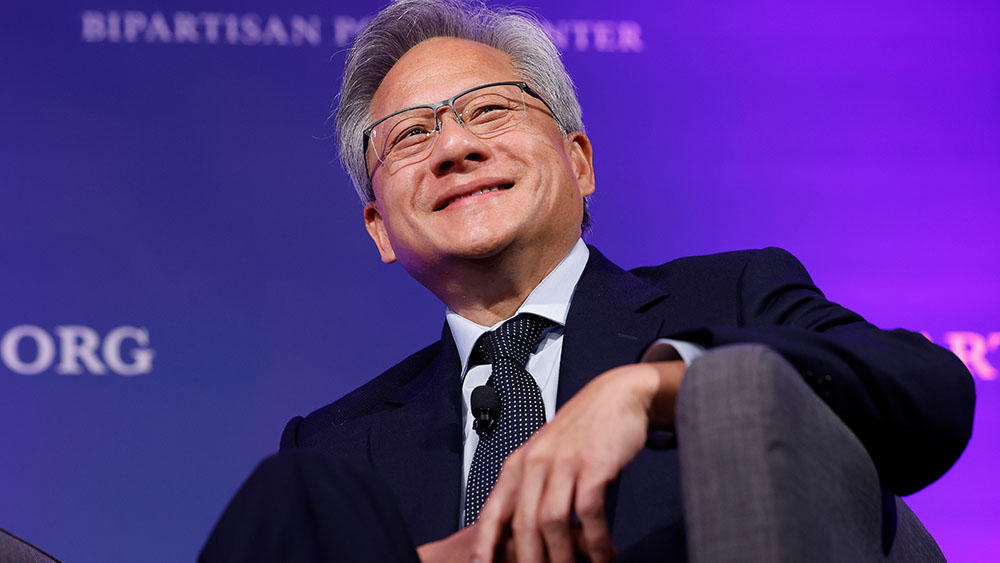

Washington's urgency to diversify rare-earth supplies has intensified since China, retaliating against U.S. tariffs, began restricting exports. U.S. President Donald Trump has openly praised Russia's "huge reserves" and explored joint extraction deals. These include a contentious agreement with Ukraine signed in May that grants the U.S. preferential access to its mineral wealth, though much of those resources lie in the Donbas region. Meanwhile, Kremlin aide Kirill Dmitriev confirmed ongoing U.S.-Russia talks, framing rare-earth collaboration as a potential bridge in otherwise strained relations. The geopolitical chessboard extends beyond minerals. Putin's directive also mandates improved transport links along Russia's borders with China and North Korea, including new rail bridges – a nod to deepening ties with both nations amid Western sanctions. While Russia currently contributes just one percent of global rare-earth output, its push for self-sufficiency mirrors broader trends of economic decoupling and resource nationalism. For now, China remains the unrivaled titan of rare earths, controlling supply chains that underpin everything from electric vehicles to missile guidance systems. But as Putin accelerates Russia's pivot eastward and Washington eyes alternatives, the race for these critical minerals could reshape alliances, trade flows and even military balances in ways not seen since the Cold War. Whether Russia emerges as a reliable supplier or a spoiler in this high-stakes game may hinge on December's roadmap – and the West's willingness to engage with a long-time adversary now holding increasingly valuable cards. Nevertheless, the race for mineral dominance is now a battleground for global power. Watch this Fox News report about Russia and the U.S. reportedly negotiating a rare earth minerals deal. This video is from the NewsClips channel on Brighteon.com. Sources include: RT.com AlJazeera.com POLITICO.eu BrightU.ai Brighteon.comAmerica losing AI battle to China due to excessive regulation, Nvidia chief warns

By Cassie B. // Share

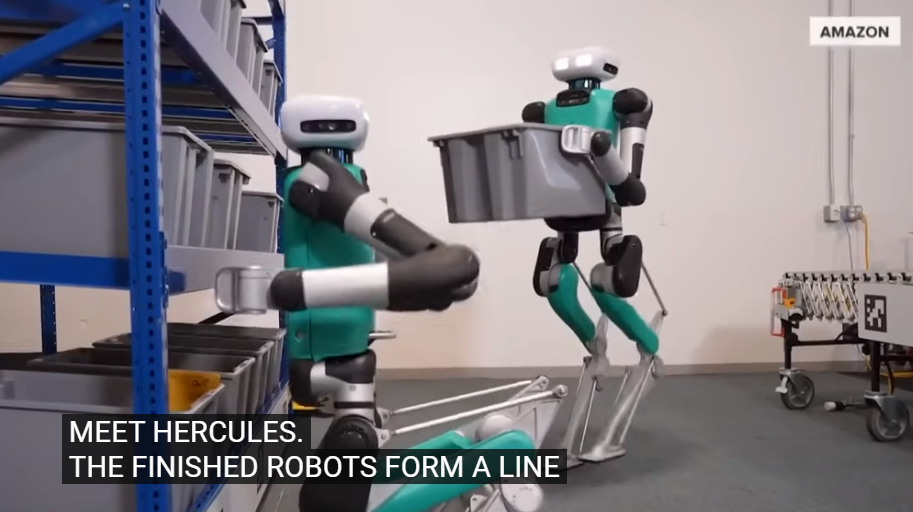

China’s expanding AI and Robotics industry raises questions about future job markets

By Finn Heartley // Share

Trump slashes fentanyl tariffs on China to 10% in major trade deal with Xi Jinping

By Kevin Hughes // Share

NVIDIA CEO introduces AI Robot TITAN, with breakthroughs in physical AI

By Lance D Johnson // Share

Trump economy in free-fall, with American households now facing record $18.59 trillion in debt

By Lance D Johnson // Share

China’s expanding AI and Robotics industry raises questions about future job markets

By finnheartley // Share

NVIDIA CEO introduces AI Robot TITAN, with breakthroughs in physical AI

By ljdevon // Share

The rose hip renaissance: Unlocking nature's potent vitamin C

By willowt // Share