Parler

Parler Gab

Gab

Robinhood announces diminished earnings a day after mass layoffs

Robinhood's mass layoff announcement was published a day before the company posted a 44 percent decline in revenues due to slumping trading activity and diminishing value in cryptocurrencies. The company's transaction-based revenue during the second quarter fell to $202 million from $451 million it posted during the second quarter of last year. A drop of more than half. Net revenue didn't paint a better picture at $318 million compared to $565 million a year ago. The company's actual net revenue is also around $3 million less than its forecast of $321 million for the second quarter, but this is still up from its first quarter net revenue of $299 million. The earnings report also showed a decline in monthly active users to 14 million, which is a 10 percent decline from the first quarter and a 33 percent decline from the second quarter of 2021, when the company reported having 21.3 million monthly active users. Assets under custody also declined by a third from the first quarter to $64.2 billion. During the second quarter of 2021, the company reported having $102 billion in assets under custody. The company went public in July 2021 at $38 per share. Its stock jumped to as high as $85 per share in its first month of trading alone. However, the stock quickly declined since then. Shares of Robinhood are down 48 percent year-to-date and closed at $9.23 per share on the day before the company announced its mass layoff. Shares went down another two percent after the release of the company's second-quarter earnings. Robinhood is not the only tech company to report a drop in earnings. Meta, Netflix, Google and other Big Tech companies are struggling to maintain the explosive growth they experienced during the pandemic. Tesla, which purchased $1.5 billion worth of bitcoin earlier this year and started accepting it as a valid payment for car purchases, just revealed that it was selling off 75 percent of its bitcoin holdings. Cryptocurrency lending and exchange platforms Coinbase and BlockFi have implemented hiring freezes and laid off hundreds of staff each. Learn more about the collapse of cryptocurrencies at CryptoCult.news. Watch this episode of the "Health Ranger Report" as Mike Adams, the Health Ranger, talks about how the Federal Reserve's interest rate hikes will further crush cryptocurrencies. This video is from the Health Ranger Report channel on Brighteon.com.More related articles:

California regulator to investigate crypto companies for not disclosing risks of crypto lending activities. Founder of fraudulent crypto CONVICTED for stealing over $6 million from investors. Cryptocurrency lending company Vauld suspending withdrawals, transactions and deposits as crypto market crash takes its toll. "Crypto Nostradamus" John Perez: $2 trillion loss in value just the start, larger crypto crash coming. Coinbase lays off 18% of workers as cryptocurrencies plummet in value. Sources include: ZeroHedge.com TheGuardian.com CNBC.com TheVerge.com Brighteon.comKeith Weiner tells Dunagun Kaiser to opt out of failing banking system and invest in gold

By Belle Carter // Share

National treasury blacklists cryptocurrency mixer Tornado Cash for laundering virtual currency

By Belle Carter // Share

Hackers could exploit software flaw in Emergency Alert System to cause mass panic

By Arsenio Toledo // Share

Debunking McGill's "dirty dozen" hit piece: Flawed sources, pharma ties, and biased reporting

By newseditors // Share

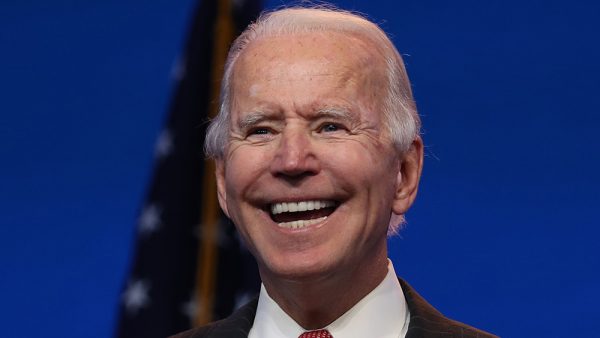

Your lyin' eyes: Corporate media panics with 'fact checks' over Biden's obvious decline

By newseditors // Share